Many of us fail to meet our financial goals at various stages throughout the year. Without adequate financial planning, one emergency or unforeseen event could topple your financial position and set you back in achieving your financial goals. That’s why we’re here to help.

The 1st step to this is to review your budget. In plain terms, budgeting entails finding out where your income goes each month. It’s reasonably simple to do.

How to draw up a budget

We created an easy-to-use monthly budget template to guide you through the process of setting up a personal budget. Get started by following the steps outlined below.

1. Download our budget template

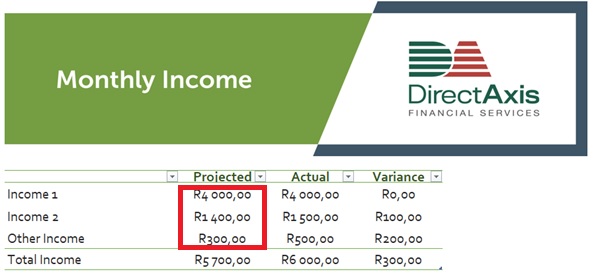

2. List your projected monthly income

On the “Monthly Income” sheet, list your monthly expected income under “Projected”.

Tip: Your monthly income may include your salary, rental income, or any commission you might earn.

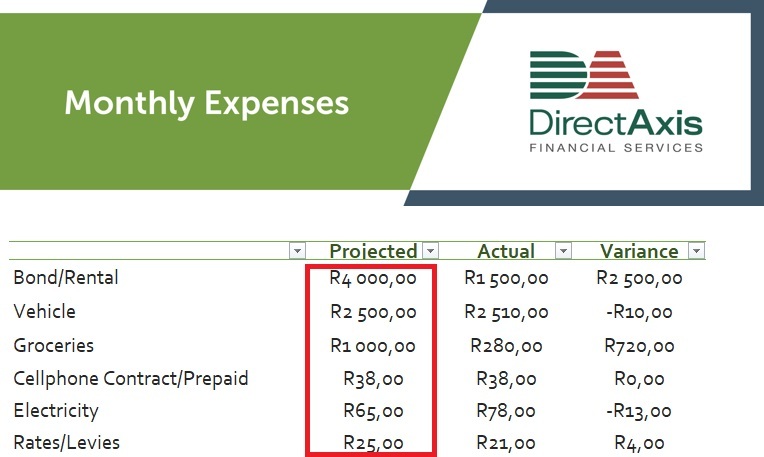

3. Gather and list your monthly expenses

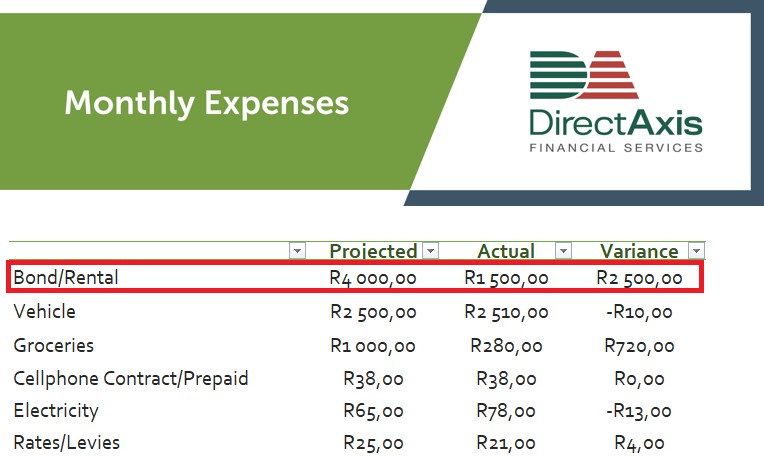

Next, on the “Monthly Expenses” sheet, list your expected monthly expenses under “Projected”.

Tip: You should be able to get most of the information from your monthly bank statement. You can use your previous bank statement to estimate what your expenses will be.

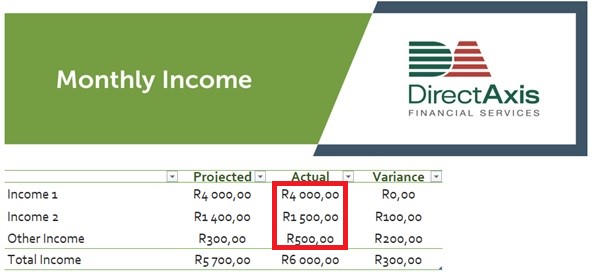

4. At the end of the month, add your actual income

On the “Monthly Income” sheet, list your actual monthly income under “Actual”. Actual income refers to any cash you received during the month. As an example, you might have received more commission than planned in a given month and it’s important to keep track of this extra income.

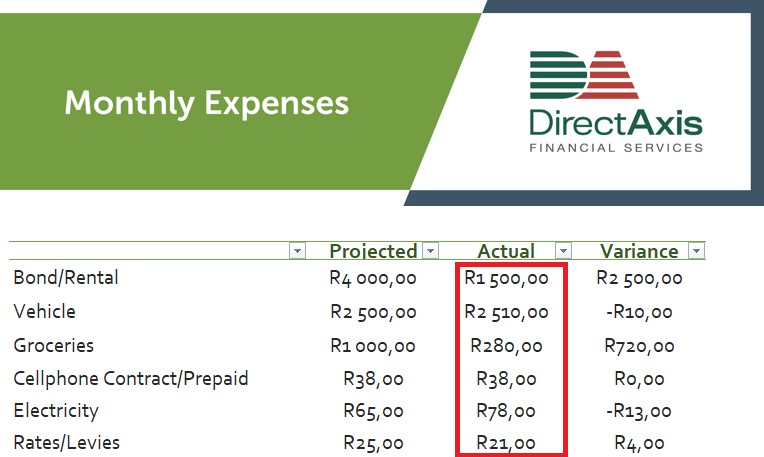

5. Lastly, add and review your actual monthly expenses

On the “Monthly Expenses” sheet, list your actual monthly expenses under “Actual”. While you might have planned to cap expenses like luxuries under a certain amount, at the end of the month, you notice you overspent on this. Recording your actual expenses helps you to keep your spending on track to meet your financial goals.

The variance column will automatically update as you populate the sheet to give you a clear picture of how you’re using your money and where you may need to make changes in your spending. If you’re spending more than expected in a given month, you will be able to save and invest less of your money at the end of the month.

6. Rinse and repeat

Repeating this budgeting exercise regularly is a good way of monitoring your financial progress.

How often should your budget be reviewed?

At DirectAxis we recommend that you review your budget at the end of every month and to use the information to plan your budget for the next month. You should further assess your budget and overall financial goals at least every year.

Why is budgeting important?

Budgeting is your key to financial security. Budgeting allows you to set up a spending plan so that you can work towards ensuring that you always have enough money on hand for the necessities, emergencies, and all things you want in life. Following your budget also helps you stay out of bad debt and can be helpful if you're trying to cut back on unnecessary expenses.

Other checks

While your budget will give you a clear understanding of your monthly cash flow, your credit score provides an independent view of how financially reliable you are.

Your credit score is a rating that everyone including landlords, credit providers and retailers use to find out how financially dependable you are. A poor credit score will limit your ability to access finance or may result in you paying higher interest rates because you’re considered a greater risk.

Managing your credit rating is another key step to managing your finances like a pro.

How to check your credit score rating

By law you’re entitled to request one free credit report annually from a registered credit bureau, however, these reports are often complex and difficult to interpret. Alternatively, you can sign up for DirectAxis Pulse for free. Pulse provides you with an easy to understand evaluation of your credit score which you can check as often as you like. The tool also tracks your credit score rating over time and provides you with additional information on how you can improve it.

Start today

With your budget in place and your credit report on hand, you will have the information you need to start setting and prioritising achievable financial goals. We wish you good luck!