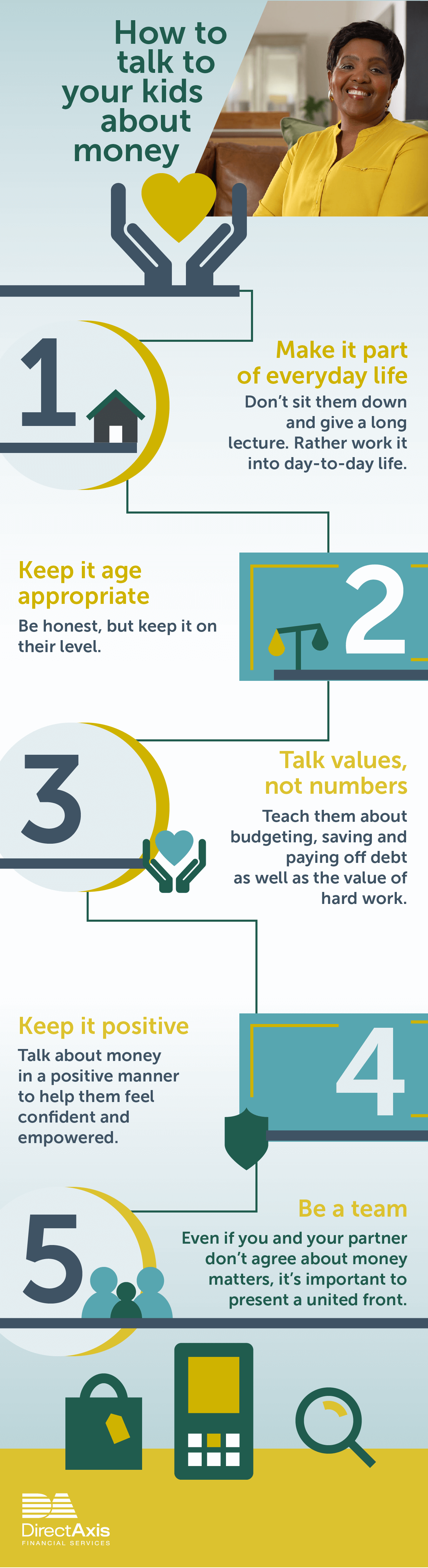

The thought of talking to your kids about money might be scary. It’s not an easy subject, especially if it keeps you up at night. But it’s important to educate them from a young age. Kids who learn about smart money management early, will be more equipped to make smart financial choices in future. Here are five guidelines to making it easier for everyone involved.

1. Make it part of everyday life

Don’t make a big deal about it. Don’t sit them down and give a long lecture. Rather work it into day-to-day life – teaching them about different aspects of money as it happens in your life. Asking your 10-year-old to help find the most affordable bottle of milk in the supermarket will be a valuable – and potentially enjoyable – lesson.

2. Keep it age appropriate

Be honest, but keep it age-appropriate. A five-year-old will not understand the concept of taking out a loan, but a teenager will.

3. Talk values, not numbers

Certain things are meant for adults only. So don’t stress about revealing your actual salary or expenses to your children. Rather focus on teaching them concepts (like budgeting, saving and paying off debt) and the value of hard work.

4. Keep it positive

In order to raise financially informed and independent children, you need to help them feel confident and empowered. So talk about money in a positive manner.

5. Be a team

Couples often don’t agree about money, but it’s important to present a united front to your children. Your disagreements might create unnecessary anxiety or uncertainty.